We have done all of the work analyzing and comparing the 2015 and 2016 curriculum to discover and share the specific 2016 CFA® exam curriculum changes for level 1 across topics, study sessions, readings all the way down to the individual Learning Outcome Statements (LOS).

Changes to the level 1 CFA® exam curriculum are carried out every year for the June test. So be careful if you are planning to use dated study materials. In most cases it is not worth it. You will be wasting time studying old readings that are no longer tested and you risk missing out on highly testable material from the new readings introduced.

This year the changes to the level 1 CFA exam curriculum have been much less dramatic than the previous year. Just one new reading (42) on risk management has been introduced and none of the old readings have been removed. Also the guideline exam weights for the individual topics remain unchanged following the changes made last year. I have included an updated list of the study sessions below. You can find more information including an updated

list of the 2016 Study Sessions and LOS on the CFA Institute’s website.

If you are resitting the test it might be tempting to just reuse last year’s study aids. I would generally recommend against it, even though the changes are minimal this year, you still need to make sure that you study the new risk management reading in addition to the 60 readings from 2015, and if your material is even older it is a definite no-go. Look out for the various types of pass guarantees that some study providers offer, these might give you a discount or a completely free upgrade on your material if you failed the test last year. To my knowledge the CFA Institute has never publicly declared if the newly added material is more likely to be tested, but it would not be surprising if they were keen to test new material, otherwise why put it in the curriculum in the first place? In my mind this is reason enough to pay extra attention to the new risk management reading and the new LOS’ added for the June 2016 exam.

Additional 2016 CFA Exam Curriculum Changes

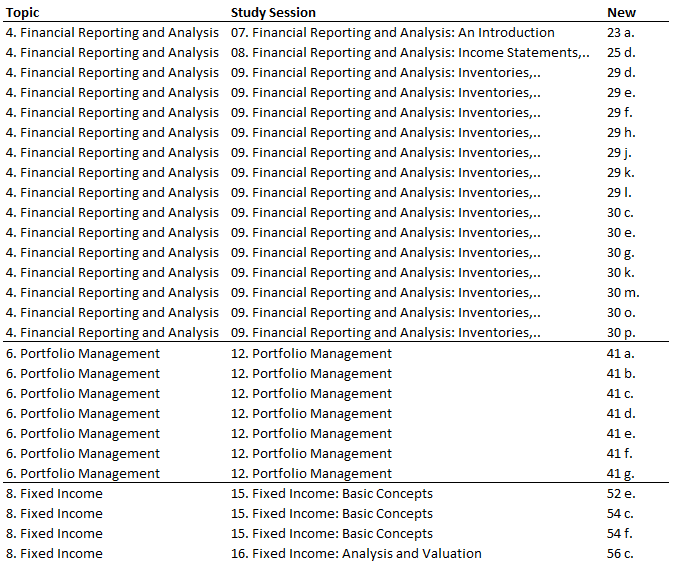

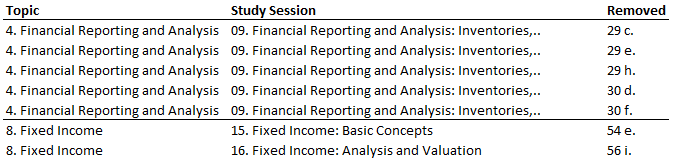

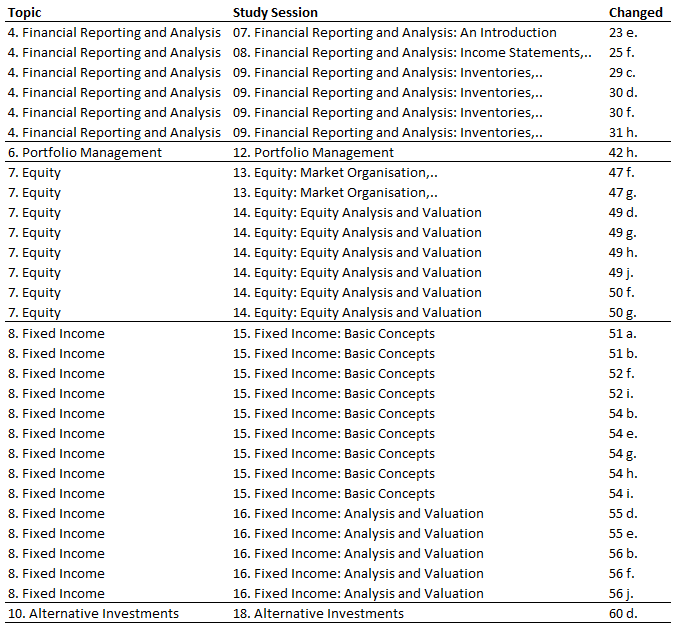

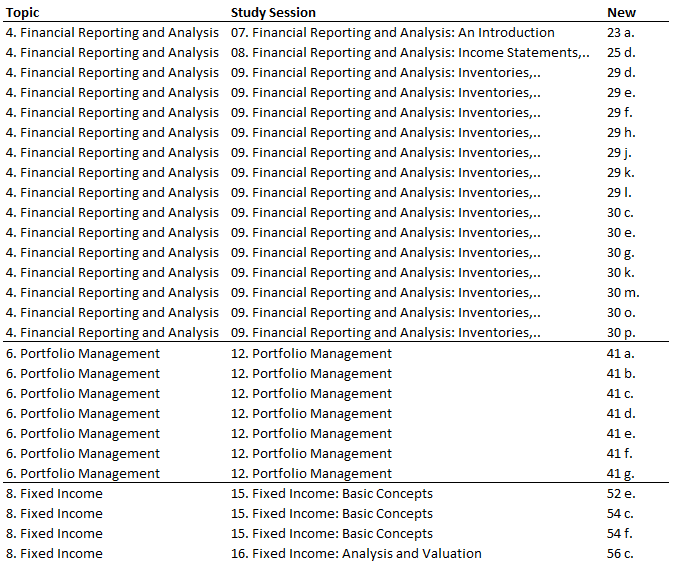

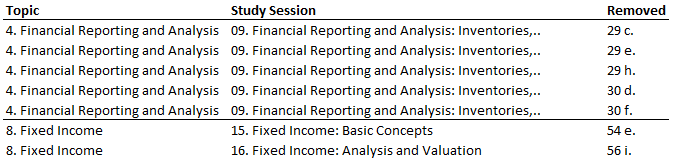

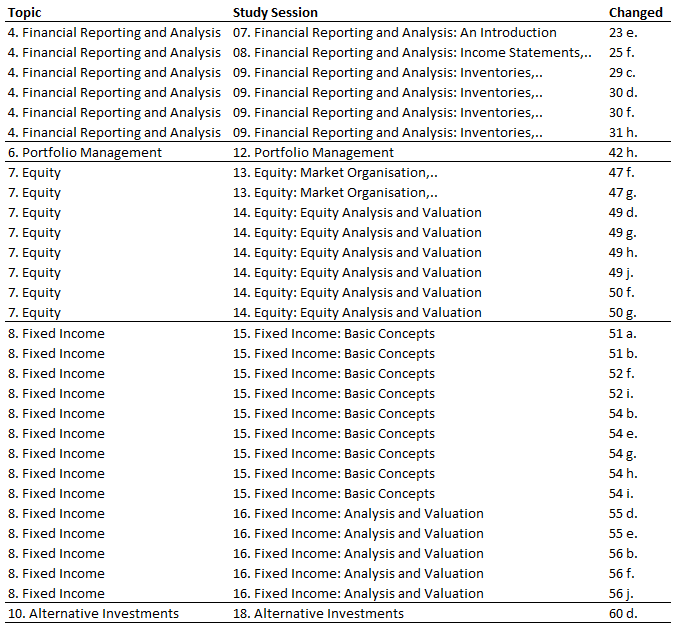

As always there were some changes to the Learning Objective Statements (LOS) since 2015. 27 new LOS have been added, 30 have been meaningfully changed and 7 have been completely removed from the curriculum. So on balance you need to study one extra reading and 20 extra LOS compared to 2015. The LOS changes affect 9 out of the 18 study sessions, and 5 out of 10 topic areas. There are no changes of note to ethics, quants, economics, corporate finance and derivatives. We have included numbered lists with the new, removed and changed LOS below.

New LOS:

Source: Financial Exam Academy (Based on the CFA® exam – level 1 curriculum – June 2016 Exam)

Removed LOS:

Source: Financial Exam Academy (Based on the CFA® exam – level 1 curriculum – June 2016 Exam)

Changed LOS:

Source: Financial Exam Academy (Based on the CFA® exam – level 1 curriculum – June 2016 Exam)

Changes to Guideline Exam Weights

The CFA Institute has decided not to alter the guideline exam weights this year. It is rarely done, but last year the Portfolio Management and Alternative Investments topics where increased by 2% and 1% respectively, while Fixed Income and Corporate Finance were reduced by 2% and 1%. This year the curriculum size of Portfolio Management has increased with the new reading, better reflecting the increase in exam weight carried out last year. By the same logic it was a bit surprising to see the extent of the Fixed Income topic area increase last year while the exam weight was reduced, but I guess there is very limited value add from trying to second guess next years curriculum changes.

Which Topics Should I Prioritize in the 2016 Curriculum?

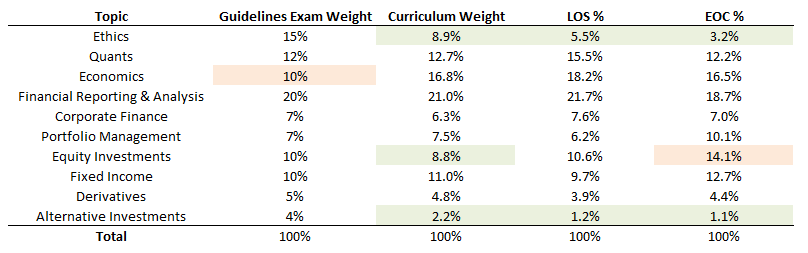

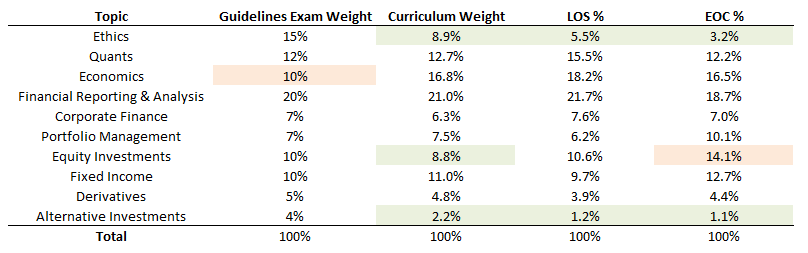

You can see the current guideline exam weights in the second column of the table below. We have also cross-examined the curriculum and worked out the percentage of words (Curriculum Weight), learning outcome statements (LOS %) and end of chapter questions (EOC %) in each topic area. This should give you a rough idea about the relationship between each topic area’s size in the curriculum compared to the guideline exam weight. As you can see Ethics is emphasized very strongly in terms of its guideline exam weight compared to its size in the underlying curriculum (The same could be said to a smaller extent about Equities and Alternatives). On the flip side of this relationship Economics makes up roughly 16.8% of the curriculum despite a humble 10% guideline exam weight. So there is a much better payoff from spending your time on each page in the Ethics topic area compared to Economics. If you have signed up for FEA Elite, you will know that we recommend using a study guide (our preferred choice is Wiley CFA Exam Review Products), when studying for the exam, but we still think it is worth it to cover Ethics in the underlying curriculum, given the favorable time/effort pay-off.

Source: Financial Exam Academy (Based on the CFA® exam – level 1 curriculum – June 2016 Exam)

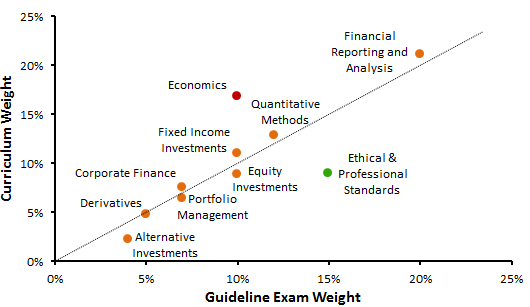

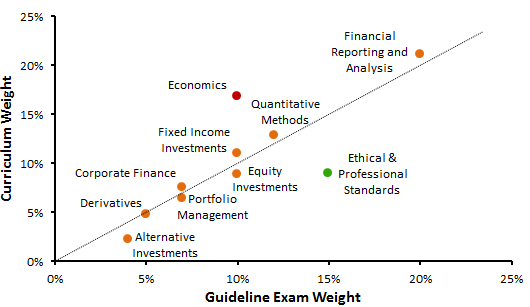

The chart below provides a more visual representation of the same relationship (the curriculum weight is based on word count). As you can see Economics stands out taking up way more space in the curriculum compared to what is warranted based on its guideline exam weight, while the opposite holds true for Ethics. You will also notice that Financial Reporting and Analysis (FRA) takes up a full 20% of the curriculum as well as the guideline exam weight. You cannot afford to lose too many points in this topic area as it will have the highest impact on your final score.

Source: Financial Exam Academy (Based on the CFA® exam – level 1 curriculum – June 2016 Exam)

Please leave a comment below or send me an email at

info@financialexamacademy.com if you have got any questions about the 2016 curriculum.

“CFA Institute does not endorse, promote or warrant the accuracy or quality of the products or services offered by Financial Exam Academy. CFA® and Chartered Financial Analyst® are trademarks owned by CFA Institute”

FTC Disclosure: “If you decide to make a purchase through my Wiley CFA Exam Review Products link, Wiley will pay me a commission for it. These commissions help to keep the rest of my content free, so thank you! This doesn’t cost you anything additional.”

"CFA Institute® does not endorse, promote or warrant the accuracy or quality of the products or services offered by Financial Exam Academy. CFA® and CFA Institute® are trademarks owned by CFA Institute®"

FTC Disclosure: “If you decide to make a purchase through my Wiley CFA Exam Review Products link, Wiley will pay me a commission for it. These commissions help to keep the rest of my content free, so thank you! This doesn’t cost you anything additional, on the contrary, as a Financial Exam Academy reader you can currently apply FEA as a voucher code and get a 10% discount on CFA products from Wiley (Please note that this coupon code cannot be combined with any other offers/coupons).”