A 3 month level 1 CFA® exam study plan does not actually afford you much time. It is definitely doable, but not without a strong commitment from you. If you have already decided to prepare for the level 1 CFA® exam in 3 months, let’s move on (But for those of you that are still on the fence it will be useful to have a look at this post to get a better idea about how many hours are required).

Practice questions:

So let’s get into the level 1 CFA® exam 3 month study plan. Question practice is key for the level 1 CFA® exam. I would allocate at least the last 3 weeks to question practice. 6 weeks would be better, but we may not have time for that given how tight this study schedule is going to be.

Text book:

Now the choice of text book is a big deal. In theory you would be best off studying the curriculum. This is after all the material that you will be tested on. But if you are only able to spend 3 months preparing for the test I will strongly recommend that you get an abbreviated study guide, and only rely on the curriculum for ethics, LOS and end of chapter questions. We recommend Wiley CFA Exam Review Products to get through the material. If you go this route, you basically rely on the study note provider to select and present the most crucial bits of the curriculum, and hope that most of the stuff that they have weeded out is not going to be tested. There is obviously a risk here, which is why I would still recommend studying Ethics based on the underlying curriculum books. Ethics takes up roughly 9.2% of the curriculum, but carries a significant 15% guideline exam weight. This topic therefore carries the most favorable trade-off between effort and exam impact and could be the defining factor if your grade is borderline. You just do not have the time to get through the entire curriculum, revise and do thorough question practice in 3 months. It is going to be a train wreck.

Flash cards and question practice:

I adapted 3 simple, yet super effective steps that I applied to every reading as I worked my way through the 3 levels of the CFA® program, the steps are as follows:

- Step 1: Create flashcards with each of the LOS (Learning Outcome Statements) in the reading. As you work your way through the reading, make an effort to seek out the answers to each of the LOS and note it down on the flip side of the flashcard making reference to the book, reading, LOS and page number. Create separate flashcards for any additional formulas, concepts and definitions that you come across. You can apply this approach to your chosen study guide. If you are using Wiley this process becomes even easier as the study notes are organized along the LOS, so the answers to stick on your flashcards are pretty much served on a silver plate.

- Step 2: Once you have finished the reading in your study guide, answer all of the reading’s end of chapter questions from the underlying curriculum. Revise and make a note of the questions that you answered incorrectly in your question log, as well as your percentage score for the reading’s end of chapter questions. You will find elsewhere on this website that I recommend maintaining a question log. This is basically a text based document, physical or digital. This day and age it is much easier to use a cloud based document that you can access from any device when on the move (Evernote would be my preferred choice).

- Step 3: Lastly re-attempt answering the flashcards and the difficult questions that you collated in the question log the following day. Revise your answers thoroughly (go back in the text and read the relevant passages if need be). If you are still struggling with some of the flashcards and end of chapter questions make a note and redo them the following day. Continue this process for as many days as necessary until you have mastered all flashcards and end of chapter questions related to that reading.

The above process forces you to be actively engaged with the learning process rather than just “passively” reading through the chapters. It is likely going to feel a bit awkward and tiresome at first, this is natural because you are forcing your brain to work harder than if you were just coasting through the material. If you are able to stick with this process throughout the curriculum however, you will not just have answered every single end of chapter question in the curriculum, you will have practiced those questions that challenge you personally multiple times until you fully understand how to answer them. In addition you will have developed some extremely useful tools for you revision process. Let’s run a thought experiment for a second. Transport yourself into the future 3 weeks prior to the exam and think for a second which position you would rather be in?

- Sitting next to your desk with flash cards containing all of the formulas, concepts, definitions and LOS from the curriculum with explanations and page references on the back along with a list of the end of chapter questions from each reading in the curriculum that you are finding challenging.

- Sitting next to your desk with the curriculum books having read all of the pages but struggling to remember what you read last week let alone 3 months ago.

I would probably go for number 1, but maybe that is just me.

Study Plan:

The described setup will leave you with about 10 weeks to get through the 10 topics in the curriculum and 3 weeks to revise and do questions. This is not a lot of time! If you go through the underlying curriculum you will need to do the end of chapter questions, create flash cards and read through more than 300 pages a week (40+ a day). Even if you decide to follow my advice and rely on the abbreviated Wiley CFA Exam Review Products you will need to plough through more than 100 pages a week (15+ a day). Depending on your reading speed it will likely take at least 20 hours a week to keep up with this study program (potentially a lot more if you plan to read every single page of the underlying curriculum). If you fall behind you will invade your 3 weeks reserved for question practice. This is not a good idea! So there is not really any way of sugar coating it. If you have only got 3 months available, you will be working hard to prepare for the test, but it can be done.

Key Sections:

All sections of the curriculum are obviously tested, but some heavier than others. It is essential that you get a good grade on Ethical & Professional Standards (Ethics) and Financial Reporting & Analysis (FRA). A solid Ethics score may make all the difference if you are a borderline pass. FRA makes up 20% of the test, and most candidates find this chapter tricky, particularly if you don’t have an accounting background. So you cannot afford to take this lightly either. You clearly should not ignore any of the other topics, but I would put that little bit of extra effort into mastering these two.

3 Month Level 1 CFA Exam Study Plan:

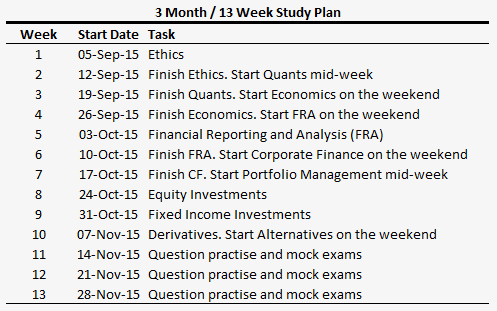

Enough talking, here is your 3 month (13 week) study plan:

Source: Financial Exam Academy (CFA® exam – level 1 curriculum – December 2015 Exam)

The time allocated to each topic is weighted according to each topics guideline weight on exam day. Some topic areas like Quants and Economics carry a higher curriculum than exam weight. Following the above schedule will force you to rush through these topics and spend more time on each page for topics like Ethics and FRA that are crucial for you to get the pass mark.

If you have got any questions on this please get in contact at info@financialexamacademy.com

Even though a 3 month study plan is doable, I would advise most candidates to spend just a little bit longer preparing for this test. If you are interested you can join our accountability partner program FEA Elite starting Jan 9, 2016 for the June 2016 test. FEA Elite is built around a 21 week study program that we consider the near optimal amount of time to allocate in order to have a good swing at the level 1 exam.