Is it realistic to expect a CFA® charter related salary hike once you have earned the 3 letters next to your name?

For a lot of people the primary motivation for getting a good education is job security and a better salary. But a lot of well educated underemployed people will testify that there is not always a clear connection between the effort put in and the monetary rewards.

As the world continues to grow wealthier and new and complicated financial products are developed there is a strong argument that we are going to see a growing need for certified financial analysts with the necessary technical know-how to navigate the markets. The CFA® program brand is globally recognized, and as such should put you at the front of the queue for these types of jobs.

Global demand for CFA charterholders is rising

According to the 2014 BCG Global Asset Management report managed assets grew 13% to a record $68.7 trillion globally in 2013 having grown 11% in 2012. Industry profits reached a record $93 billion (It should be noted that most of this growth was made up of equity market gains rather than new inflows). Net inflows made up a more modest 1.6%. Prior to the financial crisis annual net inflows in the 3-6% range were the norm. Also revenues have risen more slowly than AUM growth since the financial crisis due to fee pressure and a gradual shift away from higher margin active product categories towards passive strategies.

Global “supply” of CFA charterholders is rising faster

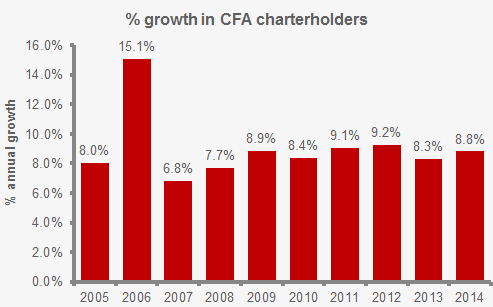

All-in-all, from a top down perspective this would seem to suggest that the demand for CFA charterholders in asset management related roles is likely growing, on the supply side of this equation however the number of CFA charterholders is growing rapidly too. The pool of CFA charterholders is around 179,291 and 14,535 (more than 8% of the total) were added last year (2014) alone. As you can see from the chart below the number of CFA charterholders has been expanding at a similar growth rate most years during the previous decade. I don’t mean to suggest that we are anywhere near satiating demand, but holding the designation today is clearly not as unique as it was even 5 or 10 years ago. Some of the growth can be explained by the increasing geographical reach of the designation, becoming globally respected. On balance, if these dynamics persist the sheer number of new charterholders will slowly erode the competitive advantage.

This however should not dissuade anybody from obtaining the charter, on the contrary there is evidence to suggest that CFA charterholder status is increasingly used as a negative rather than positive screen for filling junior positions in the industry. This dynamic is clearly visible if you look at the proportion of junior vs. senior portfolio managers and analysts that currently hold the designation. So although there are differences between firm preferences, in general the charter is increasingly becoming a need-to-have rather than a nice-to-have for aspiring individuals.

While these high level dynamics are likely to set the stage for our long term salary expectations as CFA charterholders, our individual salary expectations are likely to vary substantially based on seniority, job title, educational background, total compensation structure (bonuses, profit sharing etc.) and country of residence.

CFA charter salary expectations – Seniority:

The website payscale.com offers a very detailed analysis of the salary ranges for CFA charterholders in different jurisdictions based on various criteria. The median salary for CFA charterholders in the United States based on years of experience is as follows.

This I guess is interesting enough in itself, a further breakdown of the data however reveals a couple of key distinctions.

CFA charter salary expectations – Job titles

US CFA charterholders in portfolio management roles included in the dataset earn a median annual salary of $106K with an average bonus just above $20K. This is significantly more than the median financial analyst $65K, or investment analyst $69K, but less than the typical Chief Financial Officer with a CFA charter that bags $135K in base salary according to Payscale. You will obviously see large differences in the pay ranges for these roles regardless if you are looking at CFA charterholders or not.

Interestingly if you look at the wider peer group of all US portfolio managers (CFA charterholders and non-charterholders) they earn “just” $84K in base salary according to payscale, indicating a more than $20K advantage in base pay for CFA charterholders in this type of a role. There could clearly be many other factors at play, but this does seem to support the hypothesis that on aggregate CFA charterholders appear to command a higher salary.

CFA charter salary expectations – Educational background

It is perhaps interesting to note that the salary range for CFA charterholders that simultaneously hold an MBA ($68K-$181K) is significantly higher than the range for charterholders with a bachelors degree ($53K-$132K) in the US. As such it would appear that some people are successfully utilizing the CFA charter as a complement rather than an alternative to the MBA route.

CFA charter salary expectations – Total compensation structure

Median bonus payments for CFA charterholders appear to amount to around 12% of the median salary at the low end of the experience range increasing to roughly 20% at the more senior levels in the US. In addition commissions and profit sharing appear to make up significant amounts, particularly for the more senior CFA charterholders, albeit the data set is much thinner for these.

CFA charter salary expectations – Differences around the globe

It is interesting to note that the salary range becomes much steeper in certain jurisdictions around the world. E.g. an entry level CFA charterholder in India makes Rs 468,000 roughly equivalent to $7,500 a year (at the time of writing), whereas Indian CFA charterholders with more than 20 years experience make a massive salary jump to a median of Rs 4,200,000 roughly equivalent to $67,750. Median bonus payments are heavily skewed as well at about 10% for entry level positions rising to above 30% for senior positions. In the UK the payscale is much less steep with an entry salary of £35K (app. $54K) increasing to £73.5K (app.$113.6K) for 20 years and beyond. Median bonus payments in the UK appear slightly higher than in the US at roughly 15% for entry level positions rising to app. 25% at the senior levels.

Lastly if you are from a small country or in a niche job role chances are that you will not find much data on Payscale.com that relates directly to your circumstances. The best you can do is to try and find similar roles in similar jurisdictions to try and get a rough idea.

Final thoughts

Payscale is one of the highest authority sources of global salary statistics. Still they rely on professionals filling in their own details to receive a report about peer group salary levels, with all of the biases and inconsistencies that you would expect from such an approach. E.g. anybody reading this will quickly point out that the top of the range salary for portfolio managers and CIOs are well above the 143K and 180K listed. But then again it is probably not surprising that Bill Gross didn’t find the time to fill out the form at Payscale.com.

/Salary/by_Years_Experience.png)