What is it all about?

Most people probably associate this term with investment banking. In essence the topic area deals with the financial decisions of corporations in their pursuit to maximize shareholder value and in some cases (depending on corporate governance framework) broader stakeholder value as well. The corporate finance function at investment banks is typically focused on helping corporations raise capital (e.g. for expansion projects).

The readings

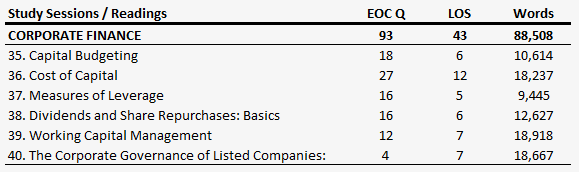

Corporate finance is organized as one large study session at level 1, subdivided into 6 relatively short readings. The first reading (39 pages) deals with basic capital budgeting processes (NPV, IRR, payback etc.). The second reading (52 pages) walks through cost of capital both from the external perspective (investors) and internal (corporate decision makers). Reading 3 (34 pages) explains measures of and business risks related to financial leverage. Reading 4 (32 pages) turns the focus to dividends and share repurchases (essentially ways in which corporate owners extract their slice of the corporate cash flows). Reading 5 (53 pages) is again focused internally on managing corporate working capital. The final reading (42 pages) introduces corporate governance, essentially the framework established to manage the conflict of interest between external owners and corporate insiders (the agency problem).

Where to focus your attention?

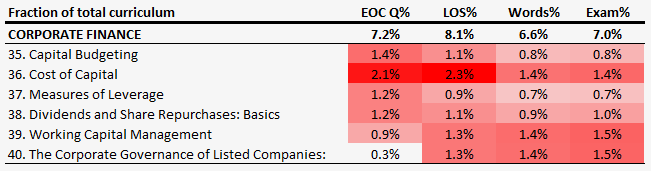

Some of the first readings feature more heavily in terms of the amount of LOS and end of chapter questions in relation to pages of curriculum. E.g. the cost of capital reading is roughly the same length as the working capital management reading but it has got roughly twice as many LOS statements and end of chapter questions. Similarly the capital budgeting reading is roughly the same length as the corporate governance reading, but it has got more than 6 times as many end of chapter questions. This is clearly no guarantee that you will find the same weighting on exam day, but it does give some indication that these readings may be more easily testable.

If you would like an explanation about how the guideline exam weights per reading are calculated it is described under the Ethics topic area.

Please reach out at info@financialexamacademy.com if you are feeling stuck in Corporate Finance and/or if you have got a specific questions about anything else related to your studies.

Next up is Portfolio Management