What is it all about?

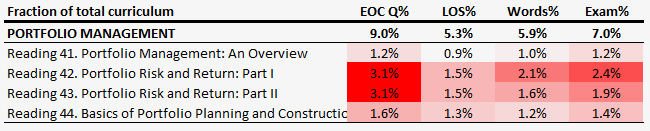

Whenever I need to describe the CFA® program to people, I usually end up explaining that it is a professional designation primarily for people working in the portfolio management industry. I know that this is not really an accurate description, and as a matter of fact portfolio management is one of the smallest topics at level 1 (The guideline exam weight is a tiny 7% and it only takes up 5.9% of the curriculum). However the topic gradually grows in significance as you progress through the 3 levels. At level 2 portfolio management makes up 5-15% of the guideline exam weight, and at level 3 portfolio management makes up roughly half of the entire exam.

The readings

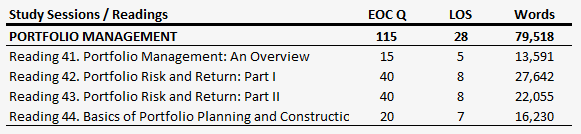

The portfolio management topic at level 1 is organized as 1 study session subdivided into 4 readings. The first reading (44 pages) provides and overview of the portfolio management function. The second (76 pages) deals with risk and return statistics. The next reading (58 pages) expands on these concepts linking them to the CAPM model. The final reading (43 pages) is about portfolio planning and construction.

Where to focus your attention?

The two risk & return chapters make up the bulk of this topic area, in terms of the number of pages, LOS and end of chapter questions. The final chapter on the basics of portfolio planning & construction is a brief introduction building the foundation for key parts of the curriculum at level 2 and particularly level 3, so it is well worth it paying attention to this. In terms of concentration of LOS and end of chapter questions there is a slight skew towards the last two readings, so well worth it paying attention there.

If you would like an explanation about how the hours per reading and minutes per page numbers are calculated have a look at the description under Ethics.

Please reach out at info@financialexamacademy.com if you are feeling stuck in Portfolio Management and/or if you have got a specific questions about anything else related to your studies.

Next up is Equity Investments