What is it all about?

Fixed income investments (as the name implies) refers to investments with a fixed payment schedule (even if the regular payment is nil, as in the case of a zero coupon bond, there is still a fixed repayment of principal). Debt is also used interchangeably with the term fixed income, as the issuer is generally an entity (private, sovereign or supranational) borrowing capital to fund its activities.

The fixed income topic remains divided into two separate study sessions for the June 2015 exam, but a new reading has been introduced compared to curriculum for the December 2014 material, so be careful relying on old study materials. The first study session is about basic fixed income concepts and the second is about fixed income analysis and risk.

The fixed income investments readings

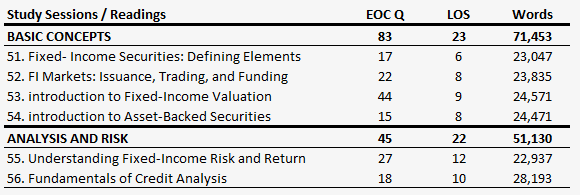

The two study sessions are made up of 4 and 2 readings respectively as illustrated above. The very first reading (20 pages) introduces the basic features of fixed income instruments, the second reading (29 pages) explores the functioning of fixed income markets, the third reading (21 pages) provides an introduction to fixed income valuation and the final reading in the first study session is a new addition about asset-backed securities.

The second study session is split into two readings. The first reading (19 pages) provides and introduction to understand fixed income risk and returns, the last reading is the largest fixed income readings dealing with the fundamentals of credit analysis.

Where to focus your attention?

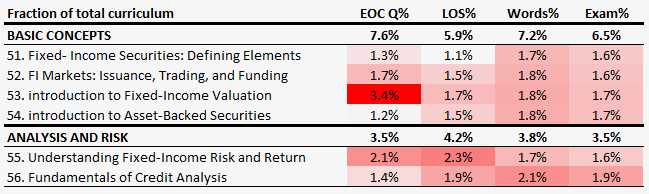

The number of readings within this topic has been reduced in recent years and provides for one of the best payoffs on time invested despite this years addition, as the topic makes up 10% of the overall score on exam day. As I have explained for all the other topic areas the density of LOS and end of chapter questions compared to number of pages in each reading deviates significantly E.g. the 3rd reading in the first study session and the first reading in the second study sessions have both got significantly more end of chapter questions than the much longer reading 56, and a comparable number of LOS. This may just be a coincidence, and there is no guarantee that this relationship will be reflected on the exam. But I would definitely make sure that I am feeling at home in the “introduction to fixed-income valuation” and “understanding fixed-income risk and return” readings.

If you would like an explanation about how the guideline exam weights per reading are calculated it is described under the Ethics topic area.

Please reach out at info@financialexamacademy.com if you are feeling stuck in Fixed Income Investments and/or if you have got a specific questions about anything else related to your studies.

Next up is Derivatives